Regulation of Factoring Services in Uzbekistan.

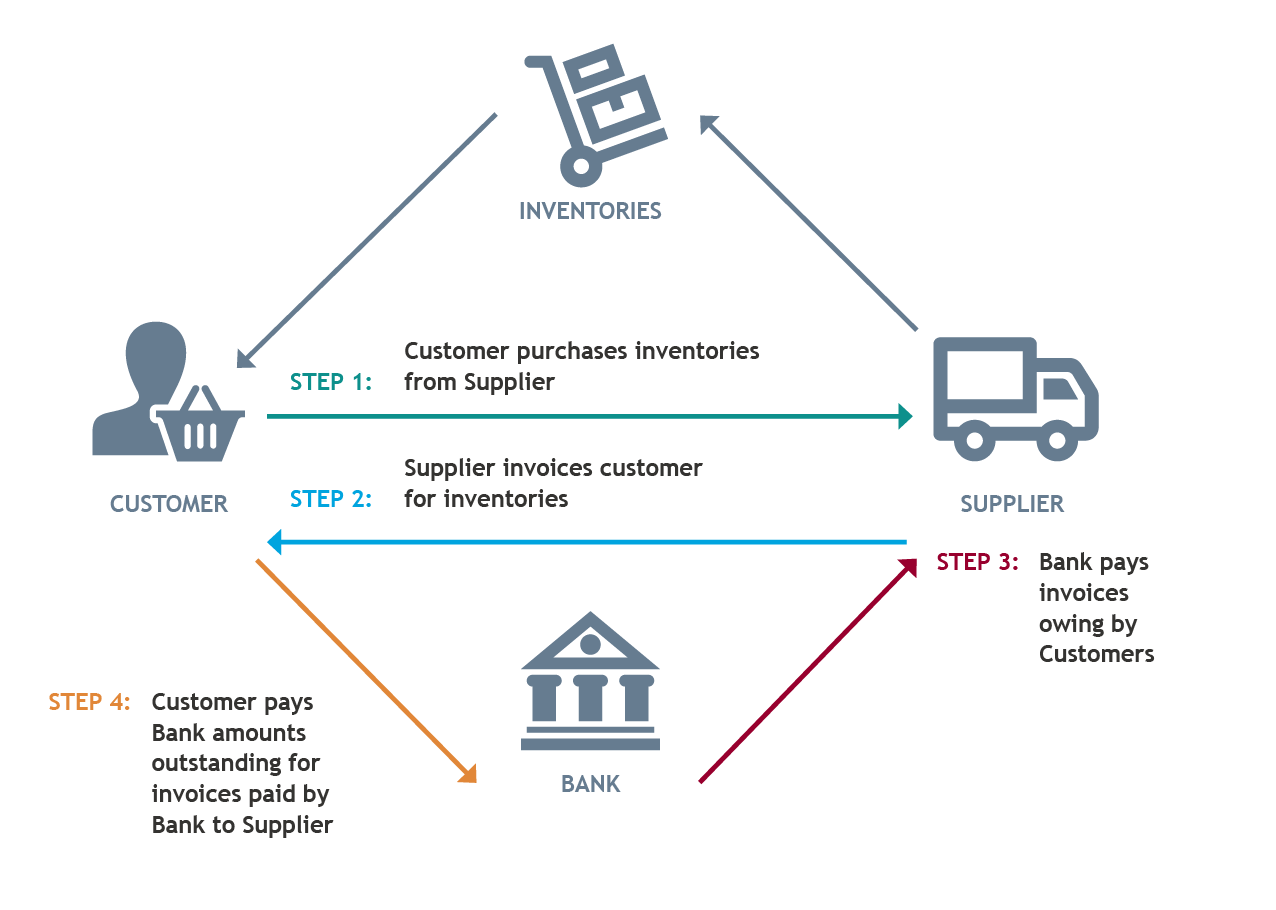

- Supplier (Client): The party providing goods or services and assigning its monetary claims arising under a contract for the sale of goods or services to the factor.

- Factor (Financial Agent): A specialized entity that acquires the supplier’s right to claim payment from its customers (debtors) and provides certain financial services.

- Non-bank credit institutions;

- Business entities with 50% or more state ownership, provided that the invoices issued under contracts are the result of a tender or selection of the best offers, with deferred payment terms.

|

The activities of a factoring organization commence upon registration with the Central Bank, which is conducted by entering the organization into the register as a non-bank credit institution (See Article 3 of the Law of the Republic of Uzbekistan "On Non-Bank Credit Institutions and Microfinance Activities," dated April 20, 2022, No. ZRU-765). |

- Debtor: The supplier’s customer, who purchases goods or services and is obligated to make payments to the factor, having been notified of the assignment of the claim.

- No Need for Additional Collateral: In contrast to traditional loan arrangements, which often require collateral (such as pledging equipment), factoring is secured by the assignment of the right to claim payment from the debtor.

- Mitigation of Bad Debt Risk: There are two types of factoring—recourse factoring and non-recourse factoring. In non-recourse factoring, the factor assumes the risk of the debtor’s non-payment, while in recourse factoring, the supplier remains liable if the debtor defaults.

- Efficiency: Factoring enables companies to reduce the time and resources needed for debt collection, as these responsibilities are transferred to the factor.

- Improved Balance Sheet: Factoring is not treated as a liability (loan) on the company’s balance sheet; rather, it is seen as an exchange of assets, thus improving financial ratios and liquidity.

- Refactoring (Assignment to Third Parties): The factor may assign the monetary obligation to other parties (refactoring).

- Lower Net Value of Receivables: The supplier typically sells the receivables at a discount. Additionally, the supplier must pay a commission to the factor, which, according to the Decree, should not exceed 10% of the value of the monetary claim.

- Limited to Deferred Payments: Factoring is generally available only for transactions with deferred payment terms. Larger companies with substantial receivables are usually more attractive to factors.

- Liability in Recourse Factoring: Under recourse factoring, the factor has the right to demand reimbursement from the supplier if the debtor fails to fulfill payment obligations, thus exposing the supplier to potential subsidiary liability.

|

Factoring |

Cession |

|

The right to claim is limited to monetary claims from buyers under contracts with deferred payment terms. |

The right to claim can be assigned from various parties, including lessees or suppliers, and can involve both monetary and non-monetary claims. |

|

Assignable to banks or non-bank credit institutions. |

Assignable to any natural or legal person. |

|

Only monetary claims can be assigned. |

Both monetary and non-monetary claims can be assigned. |

|

No consent is required, only notification to the debtor. |

No consent required unless stipulated in the agreement. |

Factoring Agreement Requirements:

- Specific Identification of Assigned Claims: The factoring agreement must precisely identify the claims being assigned. Ambiguities or errors in the wording of the agreement may result in legal disputes or even the invalidation of the contract (See Plenary Resolution of the Supreme Economic Court of the Republic of Uzbekistan dated February 28, 2003, No. 110).

- Service Fee: The agreement must specify the financial agent’s fee for acquiring the assigned claims. Clear documentation of the service cost is crucial to avoid misunderstandings or disputes.

- Recourse or Non-Recourse: The factoring agreement must specify whether the transaction is conducted with or without recourse. Non-recourse factoring implies that the risk of non-payment is entirely borne by the factor, whereas in recourse factoring, the supplier may still be held liable if the debtor defaults.

- Tax Risks: One of the primary risks for the client company is tax uncertainty. When entering into a factoring agreement, especially if the accrual method is used, questions may arise regarding the timing of income recognition. Tax authorities may interpret the date of the assignment of the monetary claim differently, which could result in claims related to inaccurate accounting or underreporting of revenue. For example, the date of signing the assignment act and the date of actual payment may fall into different tax periods, causing discrepancies in reporting.

- Civil Law Risks: The client company may face risks related to legal uncertainty in the event of disputes over assigned claims. In particular, if the debtor fails to fulfill their obligations to the factoring company, questions may arise regarding the validity of the assignment. Additionally, if the client assigns a claim that exceeds the debtor’s actual debt, the court may declare the factoring agreement invalid.

- Recourse Claim: In factoring with recourse, the client remains liable for the debtor’s obligations to the factoring company. If the debtor defaults, the client will have to repay the debt. This increases the financial burden and makes recourse factoring less advantageous compared to non-recourse factoring.

- Risk of Debtor Non-Performance: Although factoring allows the client to transfer some of the risks to the factoring company, the debtor may still fail to meet their obligations to the financial agent. This can harm the client’s reputation and lead to financial liabilities to the factor.

- Fraud and Abuse in the Use of Factoring:

- Fraudulent Transactions with Fictitious Supplies: Companies may create fictitious transactions that do not reflect actual economic activities to obtain financing. Such actions are classified as fraud, particularly if there is proof of intent to deceive the financial agent or bank. In this case, liability may arise under articles related to fraud (e.g., Article 168 of the Criminal Code of Uzbekistan).

- Insufficient Control Over Debtors: If the factoring company or bank fails to conduct proper due diligence on debtors and transactions, this may lead to significant losses when fictitious operations are discovered. Such failures in oversight by officials may be classified as negligence (Article 207 of the Criminal Code of Uzbekistan) or official forgery (Article 209 of the Criminal Code of Uzbekistan) if they participated in creating false documents.

- Resident Credit Organizations: When credit institutions providing factoring services are residents, their information is recorded in the Unified Electronic Information System for Foreign Economic Activity as recipients of foreign currency under export contracts. These financial agents are then responsible for ensuring compliance with asset repatriation requirements.

- Non-Resident Financial Agents: If the financial agents are non-residents, the responsibility for ensuring compliance with asset repatriation requirements remains with the exporter. In such cases, when funds are received under export contracts from a non-resident financial agent based on an agreement for the acquisition of receivables, the requirement for asset repatriation is considered fulfilled.

- Commission on Services: The commission (discount) retained by financial agents for their services, not exceeding 10% of the monetary claim amount, is not classified as accounts receivable.

-

Submission of Fictitious or Incomplete Invoices: Some companies may submit fictitious or incomplete invoices to factors in order to secure short-term financing without accurately reflecting their financial situation in their reports. This practice may temporarily improve their liquidity while ignoring actual financial risks.

-

Using Factoring to Conceal Loan Transactions: Certain companies may utilize factoring to disguise loan transactions on their balance sheets by representing them as the sale of receivables. This can enhance their financial indicators (e.g., by reducing leverage), potentially misleading investors and counterparties.

-

Assignment of the Same Debt to Multiple Factors: In an environment with weak legal regulation, situations may arise where the same debt is assigned to two or more factors, leading to conflicts and litigation. This can occur due to the lack of a centralized system for tracking such assignments and insufficient transparency in transactions.